Multiple Choice

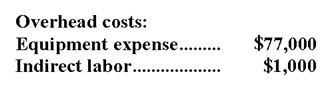

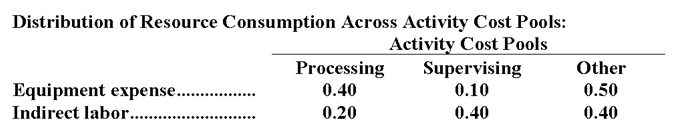

Traughber Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:

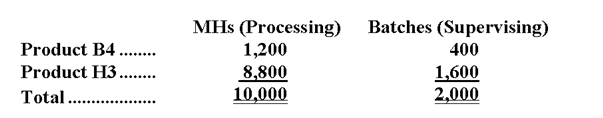

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $30,800

B) $38,900

C) $31,000

D) $200

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Laningham Corporation uses an activity based costing

Q56: Data concerning three of the activity cost

Q57: Mccance Corporation has an activity-based costing system

Q58: Goold Corporation uses activity-based costing to

Q59: Tadlock Corporation has provided the following data

Q61: Which of the following activities would be

Q62: Customer-level activities relate to specific customers and

Q63: Ballweg Corporation has an activity-based costing system

Q64: Matis Corporation's activity-based costing system has three

Q65: Madson Corporation uses an activity-based costing system