Multiple Choice

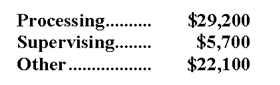

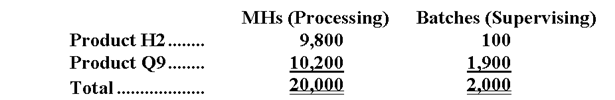

Groch Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

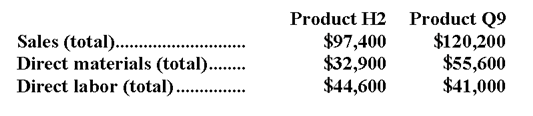

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $3.50 per batch

B) $28.50 per batch

C) $3.68 per batch

D) $2.85 per batch

Correct Answer:

Verified

Correct Answer:

Verified

Q23: In activity-based costing,there are a number of

Q36: Roshannon Corporation uses activity-based costing to compute

Q37: Dykema Corporation uses activity-based costing to compute

Q38: Demora Corporation's activity-based costing system has three

Q39: Ballweg Corporation has an activity-based costing system

Q40: Fogle Florist specializes in large floral bouquets

Q42: Activity rates from Quattrone Corporation's activity-based costing

Q44: Property taxes are an example of a

Q45: Abraham Company uses activity-based costing. The company

Q46: Austad Corporation uses activity-based costing to