Multiple Choice

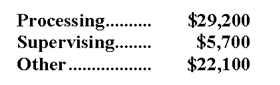

Groch Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

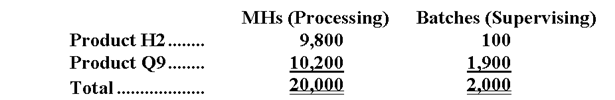

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

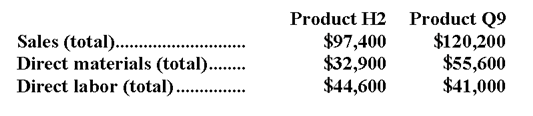

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the overhead cost assigned to Product Q9 under activity-based costing?

A) $14,892

B) $28,500

C) $5,415

D) $20,307

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Madson Corporation uses an activity-based costing system

Q66: Umanzor Corporation uses activity-based costing to assign

Q67: McKenrick Corporation uses an activity-based costing system

Q68: Capizzi Corporation has an activity-based costing system

Q69: Youd Corporation uses an activity-based costing system

Q71: Figurski Corporation uses activity-based costing to assign

Q72: Figurski Corporation uses activity-based costing to assign

Q73: A duration driver is:<br>A)A simple count of

Q74: An activity-based costing system should include all

Q75: Ollivier Corporation has an activity-based costing system