Essay

Mccance Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $28,000 for the Machining cost pool, $13,800 for the Setting Up cost pool, and $27,200 for the Other cost pool.

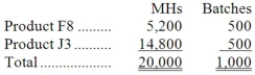

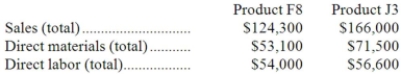

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Correct Answer:

Verified

a. Computation of activity rat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Laningham Corporation uses an activity based costing

Q44: Property taxes are an example of a

Q47: Kozloff Wedding Fantasy Company makes very elaborate

Q62: Customer-level activities relate to specific customers and

Q65: Petitte Corporation has provided the following data

Q66: Umanzor Corporation uses activity-based costing to assign

Q73: A duration driver is:<br>A)A simple count of

Q98: Ormond Corporation uses activity-based costing to assign

Q109: Dykema Corporation uses activity-based costing to compute

Q113: Roshannon Corporation uses activity-based costing to compute