Essay

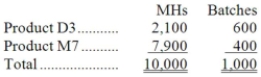

Irie Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $18,900 for the Machining cost pool, $20,500 for the Setting Up cost pool, and $23,600 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Correct Answer:

Verified

a. Computation of ac...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Andujo Company allocates materials handling cost to

Q16: Roshannon Corporation uses activity-based costing to compute

Q60: Traughber Corporation uses an activity based costing

Q68: Capizzi Corporation has an activity-based costing system

Q78: Loffredo Corporation has provided the following data

Q105: Laningham Corporation uses an activity based costing

Q113: Alongi Corporation uses the following activity rates

Q115: Gaucher Corporation has provided the following data

Q118: Pedroni Corporation uses activity-based costing to compute

Q118: Roskam Housecleaning provides housecleaning services to its