Multiple Choice

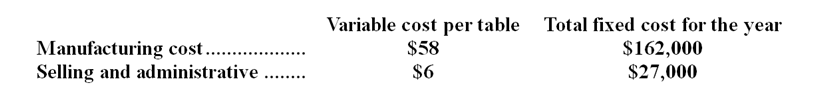

Eagle Corporation manufactures a picnic table. Shown below is Eagle's cost structure:  In its first year of operations, Eagle produced and sold 10,000 tables. The tables sold for $120 each.

In its first year of operations, Eagle produced and sold 10,000 tables. The tables sold for $120 each.

-If Eagle had sold only 9,000 tables in its first year,what total amount of cost would have been assigned to the 1,000 tables in finished goods inventory under the absorption costing method?

A) $37,100

B) $45,800

C) $58,000

D) $74,200

Correct Answer:

Verified

Correct Answer:

Verified

Q100: The Gasson Company sells three products, Product

Q101: Kilihea Corporation produces a single product. The

Q102: The Rial Company's income statement for June

Q103: Fellner Corporation produces a single product and

Q104: Favini Company, which has only one product,

Q106: Carr Company produces a single product. During

Q107: Last year,Heidenescher Corporation's variable costing net operating

Q108: The carrying value of finished goods inventory

Q109: Maga Company,which has only one product,has provided

Q110: Canon Company has two sales areas: North