Multiple Choice

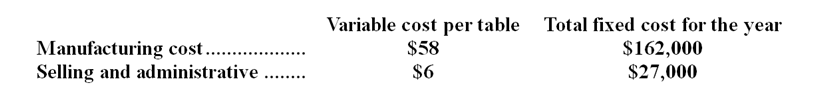

Eagle Corporation manufactures a picnic table. Shown below is Eagle's cost structure:  In its first year of operations, Eagle produced and sold 10,000 tables. The tables sold for $120 each.

In its first year of operations, Eagle produced and sold 10,000 tables. The tables sold for $120 each.

-How would Eagle's variable costing net operating income have been affected in its first year if only 9,000 tables were sold instead of 10,000?

A) net operating income would have been $37,100 lower

B) net operating income would have been $45,800 lower

C) net operating income would have been $56,000 lower

D) net operating income would have been $62,000 lower

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Clements Company, which has only one product,

Q39: Pong Incorporated's income statement for the most

Q40: Green Enterprises produces a single product. The

Q41: Craft Company produces a single product.Last year,the

Q42: Fahey Company manufactures a single product that

Q44: A manufacturing company that produces a single

Q45: Jarvinen Company, which has only one product,

Q46: Sproles Inc.manufactures a variety of products.Variable costing

Q47: Absorption costing is more compatible with cost-volume-profit

Q48: Pellman Inc., which produces a single product,