Essay

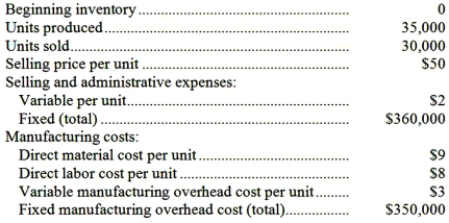

UHF Antennas, Inc., produces and sells a unique television antenna. The company has just opened a new plant to manufacture the antenna, and the following cost and revenue data have been reported for the first month of the new plant's operation:  Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Assume that direct labor is a variable cost.

Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month. Assume that direct labor is a variable cost.

Required:

a. Assuming that the company uses absorption costing, compute the unit product cost and prepare an income statement.

b. Assuming that the company uses variable costing, compute the unit product cost and prepare an income statement.

c. Explain the reason for any difference in the ending inventories under the two costing methods and the impact of this difference on reported net operating income.

Correct Answer:

Verified

a. Unit product cost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Krug Corporation manufactures a variety of products.

Q34: Condit Corporation manufactures a variety of products.

Q43: Eagle Corporation manufactures a picnic table. Shown

Q85: Falquez Company sells three products: R, S,

Q96: The contribution margin is viewed as a

Q116: Roy Corporation produces a single product. During

Q166: The Gasson Company sells three products, Product

Q175: Hadlock Company, which has only one

Q186: Favini Company, which has only one product,

Q199: The contribution margin tells us what happens