Essay

Laco Company acquired its factory building about 20 years ago. For a number of years the company has rented out a small, unused part of the building. The renter's lease will expire soon. Rather than renewing the lease, Laco Company is considering using the space itself to manufacture a new product. Under this option, the unused space will continue to be depreciated on a straight-line basis, as in past years.

Direct materials and direct labor cost for the new product would be $50 per unit. In order to have a place to store finished units of the new product, the company would have to rent a small warehouse nearby. The rental cost would be $2,000 per month. It would cost the company an additional $4,000 each month to advertise the new product. A new production supervisor would be hired to oversee production of the new product who would be paid $3,000 per month. The company would pay a sales commission of $10 for each unit of product that is sold.

Required:

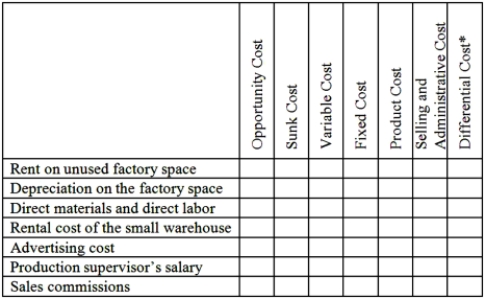

Complete the chart below by placing an "X" under each column heading that helps to identify the costs listed to the left. There can be "X's" placed under more than one heading for a single cost. For example, a cost might be a product cost, an opportunity cost, and a sunk cost; there would be an "X" placed under each of these headings on the answer sheet opposite the cost.  *Between the alternatives of (1) renting the space out again or (2) using the space to produce the new product.

*Between the alternatives of (1) renting the space out again or (2) using the space to produce the new product.

Correct Answer:

Verified

* We suggest you allow either answer (a...

* We suggest you allow either answer (a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Haar Inc.is a merchandising company.Last month the

Q36: During the month of September,direct labor cost

Q37: Electrical costs at one of Reifel

Q54: Bill Pope has developed a new device

Q55: Maintenance costs at a Tierce Corporation factory

Q57: Holzhauer Corporation, a merchandising company, reported the

Q59: Lettman Corporation has provided the following partial

Q60: The following data pertains to activity

Q61: Edeen Corporation has provided the following production

Q105: The following data have been provided by