Multiple Choice

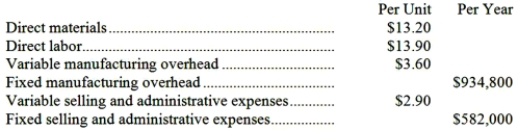

Kirsch, Inc., manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

A) $95.43

B) $72.31

C) $41.50

D) $70.60

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The following information is available on

Q9: Perin Corporation would like to use target

Q16: Hanvold Company recently changed the selling

Q17: Which of the following methods would probably

Q21: Allen Corporation's vice president in charge of

Q35: Coan Company recently changed the selling price

Q45: Nicklos Corporation's marketing manager believes that every

Q46: Coan Company recently changed the selling price

Q51: Blumstein Corporation would like to use target

Q62: Holding all other things constant,an increase in