Essay

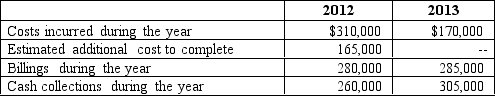

Magnum Construction contracted to construct a factory building for $545,000.The company started during 2012 and was completed in 2013.Information relating to the contract is as follows:

Required:

Required:

Record the preceding transactions in Magnum's books under completed-contract and the percentage of methods.Determine amounts that will be reported on the balance sheet at the end of 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Companies that engage in long-term contracts can

Q34: Assume that Madison Corp.has agreed to construct

Q34: Typical U.S.GAAP disclosures for deferred income taxes

Q35: The following information is related to the

Q39: A LIFO liquidation during periods when prices

Q41: Falcon Networks<br>Falcon Networks is a leading

Q66: To calculate a company's average tax rate

Q67: The major difference between accounting for pensions

Q69: Falcon Networks<br>Falcon Networks is a leading

Q72: Deferred tax liabilities result in future tax