Essay

Simmons Company

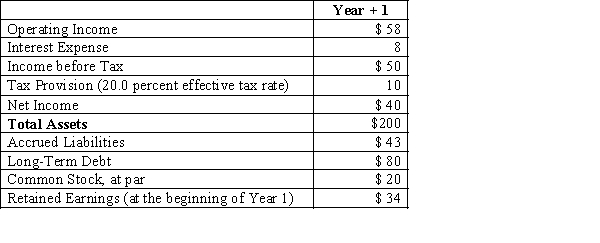

These data represent a summary of your first-iteration forecast amounts for Year 1.Simmons uses dividends as a flexible financial account.  A.See the information for Simmons Company.

A.See the information for Simmons Company.

Compute the amount of dividends you can assume that Simmons will pay in order to balance your projected balance sheet.Present the projected balance sheet.

B.See the information for Simmons Company.

Now assume that Simmons pays common shareholders a dividend of $25 in Year +1.Also assume that Simmons uses long-term debt as a flexible financial account,increasing borrowing when it needs capital and paying down debt when it generates excess capital.For simplicity,assume that Simmons pays 10.0 percent interest expense on the ending balance in long-term debt for the year and that interest expense is tax deductible at Simmons' average tax rate of 20.0 percent.

Present the projected income statement and balance sheet for Year +1.(Hint: Because of the circularity between interest expense,net income,and debt,several iterations may be needed to balance the projected balance sheet and to have the projected balance sheet articulate with net income.You may find it helpful to program a spreadsheet to work the iterative computations. )

Correct Answer:

Verified

A.This basically asks students to comput...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Projecting sales price changes depends on factors

Q20: All of the following are true regarding

Q20: One caused by using turnover ratios to

Q30: A firm in a mature industry with

Q37: In developing forecasts of expenses the analyst

Q40: As a firm progresses through the introduction

Q42: Which of the following statements does not

Q43: The formula for forecasting inventory is _

Q46: Firms that have differentiated _ for its

Q49: If a company has very low operating