Multiple Choice

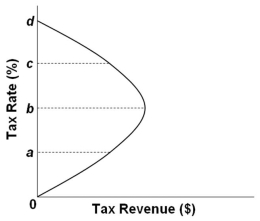

Refer to the graph above. Critics of supply-side economics would argue that tax rates are currently between:

Refer to the graph above. Critics of supply-side economics would argue that tax rates are currently between:

A) b and d and that a decrease in tax rates will decrease tax revenues

B) 0 and b and that a decrease in tax rates will decrease tax revenues

C) 0 and b and that a decrease in tax rates will increase tax revenues

D) b and d and that a decrease in tax rates will increase tax revenues

Correct Answer:

Verified

Correct Answer:

Verified

Q17: In the short run, nominal wages and

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q19: Which factor contributed to the demise of

Q21: One criticism against "supply-side" cuts in marginal

Q22: Assume contracts between workers and employers that

Q23: Supply-side policies can be described in terms

Q25: If the expected rate of inflation rises,

Q71: The adjustment mechanism that brings the economy

Q88: A stable Phillips curve does not allow

Q133: The short run in macroeconomics is a