Multiple Choice

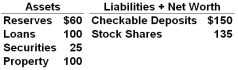

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:  Refer to the above data. If the commercial banking system actually loans out the maximum amount it is able to lend, excess reserves will fall:

Refer to the above data. If the commercial banking system actually loans out the maximum amount it is able to lend, excess reserves will fall:

A) By $28 billion

B) By $22 billion

C) By $20 billion

D) To zero

Correct Answer:

Verified

Correct Answer:

Verified

Q57: The relative importance of various asset items

Q58: Money is "created" when:<br>A) A depositor gets

Q59: What percent of the money that a

Q60: Answer the question based on the following

Q62: Assume the required reserve ratio is 16.67

Q63: If the banking system has $20 billion

Q64: Which of the following factors can contribute

Q66: Answer the question based on the following

Q267: When a bank grants a loan, the

Q271: Suppose a commercial banking system has $240,000