Multiple Choice

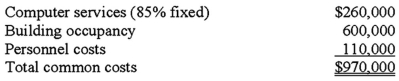

Cincinnati Million,Inc.operates two user divisions as separate cost objects.To determine the costs of each division,the company allocates common costs to the divisions.During the past month,the following common costs were incurred:  The following information is available concerning various activity measures and service usages by each of the divisions:

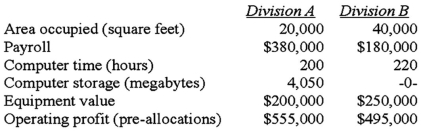

The following information is available concerning various activity measures and service usages by each of the divisions:  If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?

If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?

A) $457,286.

B) $512,714.

C) $555,000.

D) $1,087,576.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: For the purposes of allocating joint costs

Q7: Vreeland,Inc. ,manufactures products X,Y,and Z from a

Q8: Allocated joint costs are useful for:<br>A)setting the

Q10: The following set up is a system

Q65: With the reciprocal method,the total service department

Q82: The estimated net realizable value for a

Q118: The method of accounting for joint product

Q123: The selection of an allocation base in

Q134: In joint product costing and analysis,which one

Q145: In general,it is better to use a