Multiple Choice

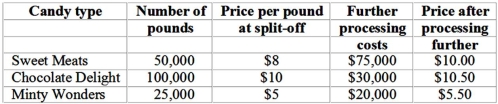

Great Sweets Candy Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  The net advantage (disadvantage) of processing Sweet Meats further is:

The net advantage (disadvantage) of processing Sweet Meats further is:

A) a $25,000 disadvantage to process further.

B) a $32,143 advantage to process further.

C) a $25,000 advantage to process further.

D) a $282,143 disadvantage to process further.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of the following departments is not

Q59: Brandeis Corporation has two production Departments: P1

Q59: One reason to allocate service department costs

Q60: Zebra Manufacturing Company incurred a joint cost

Q63: Harry Dishman owns and operates Harry's Septic

Q65: Great Sweets Candy Company produces various types

Q67: Lankip Company produces two main products and

Q69: The Moody Company produced three joint products

Q138: In a sell-or-process-further decision,the additional costs incurred

Q151: Which of the following statements is <b>false</b>?<br>A)