Multiple Choice

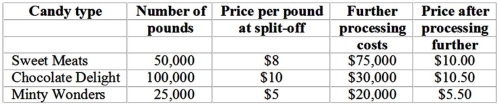

Great Sweets Candy Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  The joint processing costs in this operation:

The joint processing costs in this operation:

A) should be allocated to products to determine whether they are sold at split-off or processed further.

B) should be ignored in determining whether to sell at split-off or process further.

C) should be ignored in making all product decisions.

D) are never included in product cost,as they are misleading to all management decisions.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of the following statements is(are)false regarding

Q27: Which of the following statements is <u>false

Q42: Which of the following statements regarding accounting

Q48: Anchorage Company manufactures three main products,L,M,and N,from

Q51: LaCrescent University has 20 departments.Two of its

Q52: Product C is one of several joint

Q52: Brandeis Corporation has two production Departments: P1

Q54: If by-product revenue is treated as other

Q74: Joint products are outputs from common inputs

Q88: Which of the following is not a