Multiple Choice

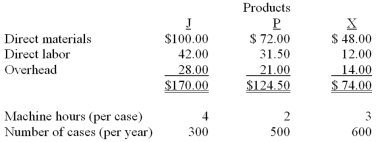

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product P?

If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product P?

A) $163.50.

B) $144.00.

C) $138.15.

D) $117.15.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: When overhead is applied based on the

Q54: Activity-based costing (ABC)provides more detailed measures of

Q57: Which of the following should not be

Q58: In general,traditional product costing methods allocate less

Q78: Zela Company is preparing its annual profit

Q79: Zela Company is preparing its annual profit

Q80: The basic difference between the department cost

Q82: Smelly Perfume Company manufactures and distributes several

Q83: RS Company manufactures and distributes two products,R

Q144: The department cost allocation method provides more