Multiple Choice

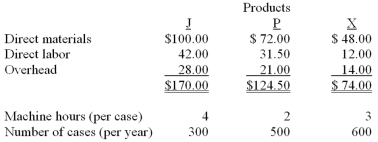

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product J?

Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product J?

A) $175.33.

B) $161.50.

C) $169.30.

D) $183.36.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Activity-based costing (ABC) is a costing technique

Q6: Multiple (departmental)manufacturing overhead rates are considered preferable

Q38: Predetermined overhead rates are used in first-stage

Q45: Activity-based costing (ABC)is a two-stage cost allocation

Q46: Traditional product costing systems (e.g. ,job and

Q61: Which of the following activities would be

Q68: The death spiral concept refers to the

Q89: It is possible to apply activity-based costing

Q104: Using direct labor costs to allocate overhead

Q143: Companies using activity-based costing (ABC)have learned that