Multiple Choice

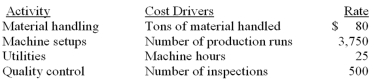

The LMN Company recently switched to activity-based costing (ABC) from the department allocation method.The department method allocated overhead costs at a rate of $60 per machine hour.The cost accountant for Department XZ has gathered the following data:  During April,LMN purchased and used $100,000 of direct materials at $20 per ton.There were eight (8) production runs using a total of 12,000 machine hours in April.The manager of Department XZ needed 12 inspections.Actual overhead costs totaled $820,000 for the month.How much overhead costs were applied to the Work-in-Process Inventory during April using activity-based costing?

During April,LMN purchased and used $100,000 of direct materials at $20 per ton.There were eight (8) production runs using a total of 12,000 machine hours in April.The manager of Department XZ needed 12 inspections.Actual overhead costs totaled $820,000 for the month.How much overhead costs were applied to the Work-in-Process Inventory during April using activity-based costing?

A) $536,000.

B) $720,000.

C) $736,000.

D) $820,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Property taxes are an example of a

Q48: Smelly Perfume Company manufactures and distributes several

Q49: Cost pools are used with: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2418/.jpg"

Q51: Management estimates that it costs $400 to

Q52: What is the typical effect on the

Q54: Scottso Enterprises has identified the following overhead

Q55: Smelly Perfume Company manufactures and distributes several

Q56: Smelly Perfume Company manufactures and distributes several

Q57: Terri Martin,CPA provides bookkeeping and tax services

Q58: Which of the following would NOT be