Multiple Choice

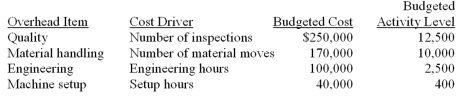

Scottso Enterprises has identified the following overhead costs and cost drivers for the coming year:  Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:

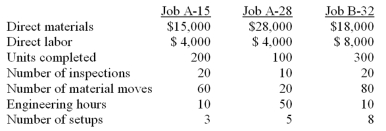

Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:  If the company uses traditional costing and allocates overhead using direct materials cost,how much overhead cost should be assigned to Job A-15?

If the company uses traditional costing and allocates overhead using direct materials cost,how much overhead cost should be assigned to Job A-15?

A) $10,500.

B) $11,200.

C) $2,800.

D) $2,050.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: In general,traditional product costing methods allocate less

Q61: Which of the following costs is not

Q69: Smelly Perfume Company manufactures and distributes several

Q70: The Muskego National Bank is considering either

Q71: Zela Company is preparing its annual profit

Q74: Terri Martin,CPA provides bookkeeping and tax services

Q75: The Muskego National Bank is considering either

Q78: Zela Company is preparing its annual profit

Q98: The number of products produced is an

Q144: The department cost allocation method provides more