Multiple Choice

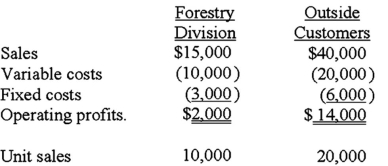

The Blade Division of Axe Company produces hardened steel blades.One-third of Blade's 30,000 unit output is sold to the Forestry Products Division of Axe;the remainder is sold to outside customers.Blades' estimated operating profit for the year is:  The Forestry Division has an opportunity to purchase 10,000 blades of the same quality from an outside supplier on a continuing basis.The purchase price would be $1.25.If the Blade Division is now operating at full capacity and can sell all its units to outside customers at the present selling price,what is the differential cost to Axe of requiring that the blades be made internally and sold to the Forestry Division?

The Forestry Division has an opportunity to purchase 10,000 blades of the same quality from an outside supplier on a continuing basis.The purchase price would be $1.25.If the Blade Division is now operating at full capacity and can sell all its units to outside customers at the present selling price,what is the differential cost to Axe of requiring that the blades be made internally and sold to the Forestry Division?

A) $2,500.

B) $5,000.

C) $7,500.

D) $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Differential analysis involves the comparison of one

Q3: Financial statements prepared in accordance with generally

Q13: Exporting a product to another country at

Q23: The Buchanan Company has gathered the following

Q25: Differential analysis <b>cannot</b> be used for long-run

Q26: Roswell Inc has 5,400 machine hours available

Q29: A target cost is computed as:<br>A) cost

Q62: The theory of constraints focuses on determining

Q68: The alternative courses of action in a

Q69: Price discrimination is the practice of selling