Multiple Choice

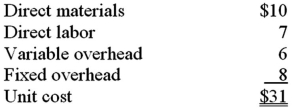

The following information relates to a product produced by Ashland Company:  Fixed selling costs are $1,000,000 per year.Variable selling costs of $4 per unit sold are added to cover the transportation cost.Although production capacity is 500,000 units per year,Ashland expects to produce only 400,000 units next year.The product normally sells for $40 each.A customer has offered to buy 60,000 units for $30 each.The customer will pay the transportation charge on the units purchased.If Ashland accepts the special order,the effect on income would be a:

Fixed selling costs are $1,000,000 per year.Variable selling costs of $4 per unit sold are added to cover the transportation cost.Although production capacity is 500,000 units per year,Ashland expects to produce only 400,000 units next year.The product normally sells for $40 each.A customer has offered to buy 60,000 units for $30 each.The customer will pay the transportation charge on the units purchased.If Ashland accepts the special order,the effect on income would be a:

A) $60,000 increase.

B) $180,000 increase.

C) $420,000 increase.

D) $600,000 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The differential analysis approach to pricing for

Q20: The practice of setting price below cost

Q62: Miller Industries has two divisions: the West

Q65: The Axle Division of Becker Company produces

Q67: Which of the following costs are not

Q69: The CJP Company produces 10,000 units of

Q70: The operations of Superior Corporation are divided

Q91: The theory of constraints focuses on maximizing

Q98: Only variable costs can be differential costs.

Q122: Fixed costs are always classified as sunk