Multiple Choice

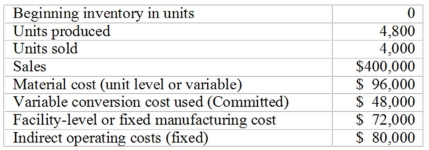

The difference between the variable ending inventory cost and the absorption ending inventory cost is:

The difference between the variable ending inventory cost and the absorption ending inventory cost is:

A) 800 units times $15 per unit indirect manufacturing cost.

B) 800 units times $10 per unit material cost.

C) 800 units times $20 per unit variable conversion cost plus $15 per unit indirect manufacturing cost.

D) 800 units times $20 per unit variable conversion cost plus $15 per unit indirect manufacturing cost plus $16.67 per unit indirect operating costs.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The costs of direct materials are classified

Q3: The amount of direct materials issued to

Q4: An opportunity cost is<br>A)a cost that is

Q5: Which of the following statements is (are)false?

Q6: Laner Company has the following data for

Q8: Variable marketing and administrative costs are included

Q9: An expense is an expired cost matched

Q10: Which terms below correctly describe the cost

Q11: Makwa Industries has developed two new products

Q70: The difference between variable costs and fixed