Multiple Choice

-The Social Security tax is considered to be a

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) marginal tax.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q26: Which of the following is NOT an

Q27: Using the fiscal year 2017 estimates, the

Q28: An example of a regressive tax is

Q29: Social Security taxes are paid by<br>A) employers

Q30: Dynamic tax analysis assumes that<br>A) an increase

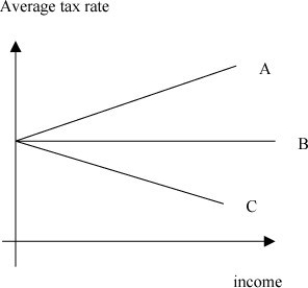

Q32: "Only in a progressive tax system does

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Using the above

Q34: Suppose the income tax rate schedule is

Q35: Under a progressive income tax system, the

Q36: The federal income tax code of the