Multiple Choice

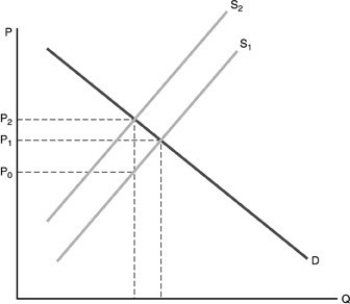

-When a unit tax of $2 is levied on a product

A) the entire $2 is paid by the consumer.

B) the entire $2 is paid by the producer.

C) both the consumer and producer pay $2 each.

D) the consumer pays part of the $2 and the producer pays the rest.

Correct Answer:

Verified

Correct Answer:

Verified

Q74: If you were to face a marginal

Q75: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -The demand and

Q76: How can we anticipate the proportion of

Q77: Which of the following is an argument

Q78: The largest share of federal government tax

Q80: Suppose the tax rate on the first

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -An excise tax

Q82: The distributions of tax burdens among various

Q83: Corporate profits are taxed twice because<br>A) taxes

Q84: A tax levied on purchases of a