Multiple Choice

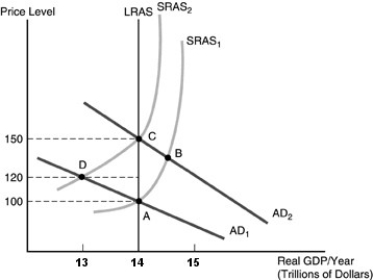

-Refer to the above figure. Suppose the economy is in equilibrium at point A. If the Fed tries to stimulate the economy by undertaking an expansionary monetary policy action and this is NOT expected by the people in the economy, we would expect to see

A) aggregate demand increases, real GDP increases, and the price level increases. In the long run, aggregate supply would increase and the new long-run equilibrium would be point B.

B) aggregate demand increases, real GDP increases, and the price level increases in the short run. In the long run, people realize the real situation, causing the short-run aggregate supply curve to shift up. Real GDP returns to $14 trillion, and the price level increases to 150.

C) aggregate demand increases but people would anticipate this, causing the short-run aggregate supply curve to shift up at the same time, with the new equilibrium of $14 trillion of real GDP and a price level of 100.

D) aggregate supply shifts up as people anticipate the effects of the expansionary monetary system. In the short run, real GDP falls to $13 trillion and the price level rises to 120. In the long run, real GDP returns to $14 trillion, and the price level increases further, to 150.

Correct Answer:

Verified

Correct Answer:

Verified

Q272: Proponents of passive policymaking believe that<br>A) the

Q273: One implication of coupling the rational expectations

Q274: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -In the above

Q275: When the economy is operating at a

Q276: Under the rational expectations hypothesis, if wages

Q278: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the

Q279: Which of the following hypotheses states that

Q280: A reduction in world oil supplies is

Q281: Suppose there was an unexpected increase in

Q282: Which of the following holds that economic