Multiple Choice

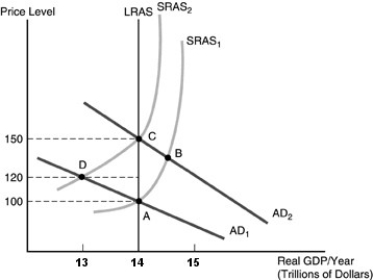

-Refer to the above figure. Suppose the economy is in long-run equilibrium at point A, and the government initiates an expansionary monetary policy to increase aggregate demand. Which of the following is a TRUE statement concerning the differences between what happens when the central bank action is unanticipated and when it is anticipated?

A) The new long-run equilibrium when the increase in aggregate demand is unanticipated is point B while the new long-run equilibrium when the increase in aggregate demand is anticipated is point C.

B) The new long-run equilibrium when the increase in aggregate demand is unanticipated is point B while the new long-run equilibrium when the increase in aggregate demand is anticipated is point A.

C) The new long-run equilibrium will be point C in either case. When the increase in aggregate demand is unanticipated, the economy moves to B in the short run, but when the increase in aggregate demand is anticipated, short-run aggregate supply shifts when the aggregate demand curve shifts, and the economy moves immediately to point C.

D) The new long-run equilibrium is point C in either case. When the increase in aggregate demand is unanticipated, the new short-run equilibrium is point B, but when the increase in aggregate demand is anticipated the new short-run equilibrium is point D.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: According to the policy irrelevance proposition<br>A) monetary

Q12: Expansionary fiscal policy can be used to

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the

Q14: The policy irrelevance proposition implies that<br>A) unanticipated

Q15: According to economists who support passive policymaking<br>A)

Q17: According to New Keynesian economists<br>A) activist policy

Q18: The natural rate of unemployment is<br>A) the

Q19: If households and businesses correctly anticipate the

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -In the above

Q21: The policy irrelevance proposition suggests that the