Multiple Choice

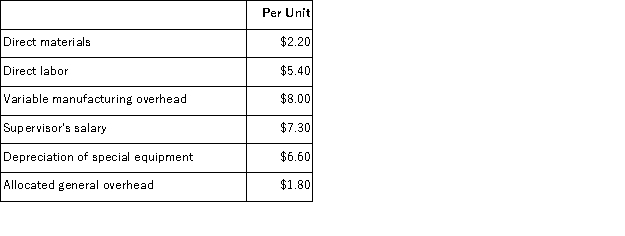

Ramon Corporation makes 18, 000 units of part E44 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $5, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part E44 would be used to make more of one of the company's other products, generating an additional segment margin of $21, 000 per year for that product. What would be the impact on the company's overall net operating income of buying part E44 from the outside supplier?

An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $5, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part E44 would be used to make more of one of the company's other products, generating an additional segment margin of $21, 000 per year for that product. What would be the impact on the company's overall net operating income of buying part E44 from the outside supplier?

A) Net operating income would increase by $21, 000 per year.

B) Net operating income would increase by $18, 800 per year.

C) Net operating income would decrease by $123, 000 per year.

D) Net operating income would decrease by $165, 000 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Gierlach Beet Processors, Inc., processes sugar beets

Q78: Brown Corporation makes four products in a

Q79: Albertine Co.manufactures and sells trophies for winners

Q80: Bowen Corporation produces products P, Q, and

Q82: The management of Kabanuck Corporation is considering

Q84: Crane Corporation makes four products in a

Q85: Paulsen Corporation makes two products, W and

Q87: Brown Corporation makes four products in a

Q88: The management of Fannin Corporation is considering

Q137: Two products, LB and NH, emerge from