Multiple Choice

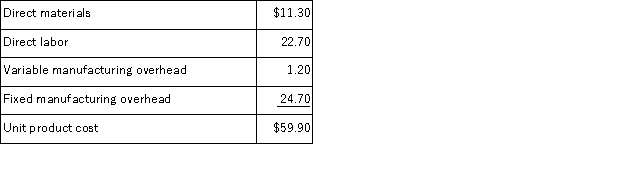

Aholt Corporation makes 40, 000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

A) $264, 000

B) $(328, 000)

C) $548, 000

D) $(64, 000)

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Lusk Corporation produces and sells 20,000 units

Q74: A cost that is traceable to a

Q123: The management of Cackowski Corporation has been

Q124: Tullius Corporation has received a request for

Q125: Moyer Corporation is a specialty component manufacturer

Q127: Tillison Corporation makes three products that use

Q130: Crane Corporation makes four products in a

Q131: Hoang Corporation makes three products that use

Q132: Part A42 is used by Elgin Corporation

Q133: Part O43 is used in one of