Multiple Choice

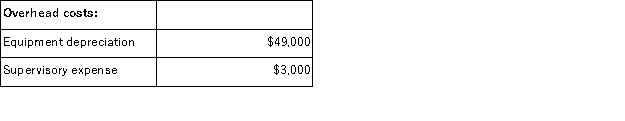

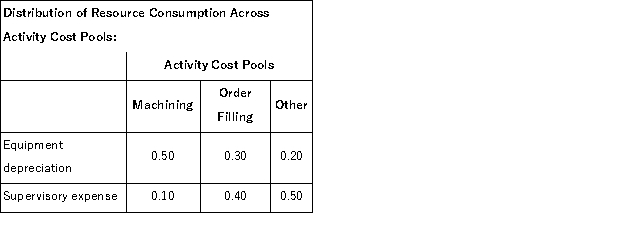

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

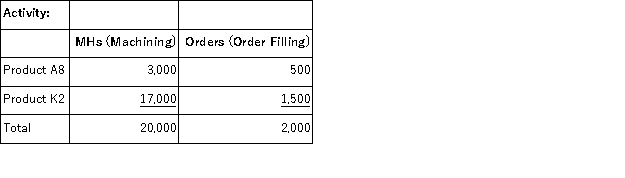

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

A) $2.60 per MH

B) $1.23 per MH

C) $0.60 per MH

D) $1.24 per MH

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Which of the following would probably be

Q64: Mouret Corporation uses the following activity rates

Q65: Trainor Corporation uses activity-based costing to assign

Q68: Studler Corporation has an activity-based costing system

Q69: Dideda Corporation uses an activity-based costing system

Q70: Conely Corporation has provided the following data

Q71: Stroth Corporation uses activity-based costing to compute

Q72: Munar Corporation uses activity-based costing to compute

Q98: An activity-based costing system that is designed

Q121: Organization-sustaining overhead costs should be allocated to