Multiple Choice

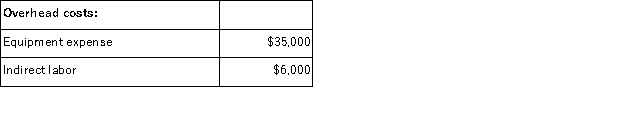

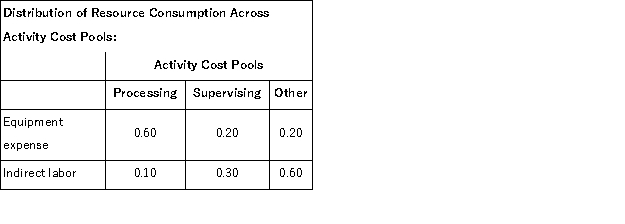

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

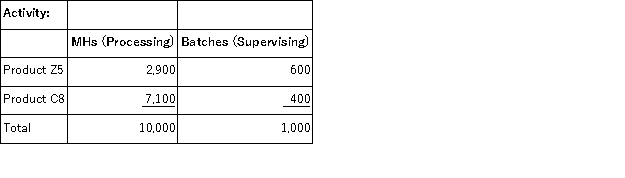

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

A) $2.16 per MH

B) $2.10 per MH

C) $4.10 per MH

D) $1.00 per MH

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Andruschack Corporation uses activity-based costing to determine

Q22: Thoen Nuptial Bakery makes very elaborate wedding

Q23: Brannum Corporation has provided the following data

Q24: Garhart Corporation uses the following activity rates

Q25: Koutz Corporation uses activity-based costing to compute

Q28: Studler Corporation has an activity-based costing system

Q29: Trainor Corporation uses activity-based costing to assign

Q30: The Thornes Cleaning Brigade Company provides housecleaning

Q31: Senff Corporation uses the following activity rates

Q133: Product-level activities relate to how many batches