Multiple Choice

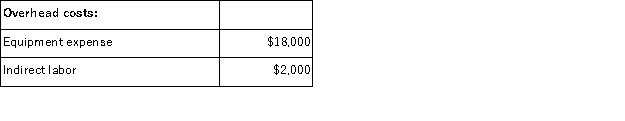

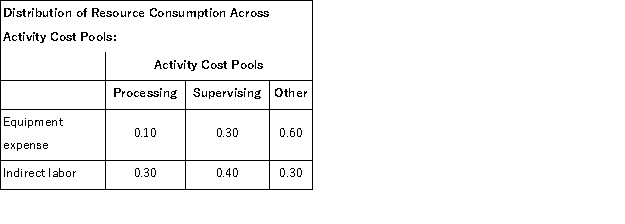

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

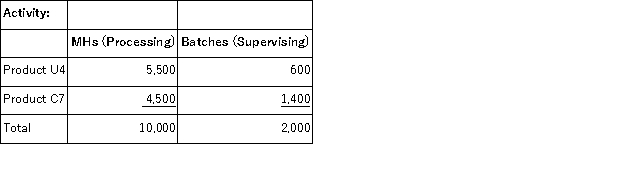

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

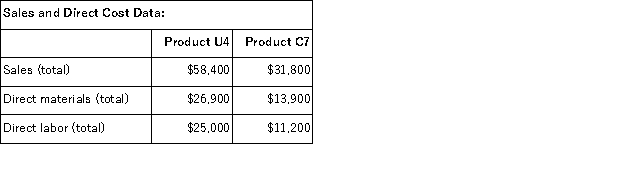

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $2, 400

B) $600

C) $1, 800

D) $11, 400

Correct Answer:

Verified

Correct Answer:

Verified

Q65: In activity-based costing, some manufacturing costs can

Q72: Activity rates are computed in the second-stage

Q77: Rosenbrook Corporation has provided the following data

Q81: Zumbrunnen Corporation uses activity-based costing to compute

Q84: Radakovich Corporation has provided the following data

Q85: Activity rates from Mcelderry Corporation's activity-based costing

Q86: Dideda Corporation uses an activity-based costing system

Q87: The following data have been provided by

Q97: Activity-based management seeks to eliminate waste by

Q103: The first-stage allocation in activity-based costing is