Essay

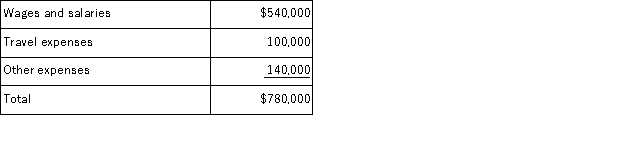

Fife & Jones PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools.The company has provided the following data concerning its costs and its activity based costing system:

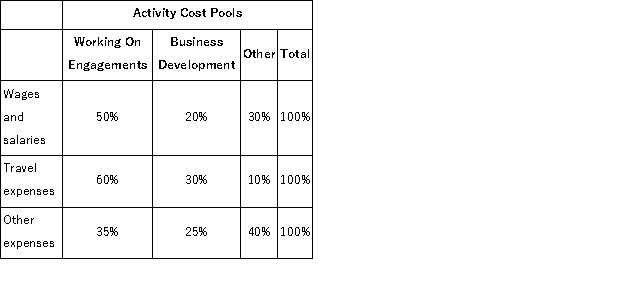

Costs:  Distribution of resource consumption:

Distribution of resource consumption:  Required:

Required:

a.How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b.How much cost, in total, would be allocated to the Business Development activity cost pool?

c.How much cost, in total, would be allocated to the Other activity cost pool?

Correct Answer:

Verified

All three parts can be answered using a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Radakovich Corporation has provided the following data

Q85: Activity rates from Mcelderry Corporation's activity-based costing

Q86: Dideda Corporation uses an activity-based costing system

Q87: The following data have been provided by

Q88: Manton Corporation uses an activity based costing

Q90: The controller of Hartis Corporation estimates the

Q91: Carsten Wedding Fantasy Corporation makes very elaborate

Q92: Monson Corporation has two products: G and

Q93: Mussenden Corporation has an activity-based costing system

Q94: Stroth Corporation uses activity-based costing to compute