Foradori Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Fabricating

Essay

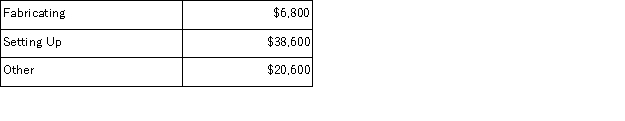

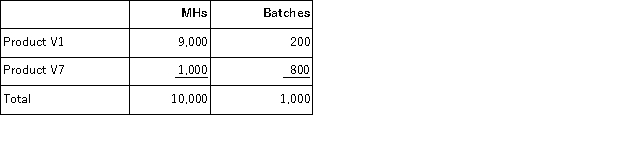

Foradori Corporation's activity-based costing system has three activity cost pools-Fabricating, Setting Up, and Other.The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Direct labor-hours or direct labor cost should

Q59: In traditional costing, some manufacturing costs may

Q66: Activity-based costing involves a two-stage allocation in

Q115: Betterton Corporation uses an activity based costing

Q116: Dace Company manufactures two products, Product F

Q118: Deraney Corporation has an activity-based costing system

Q120: Forse Florist specializes in large floral bouquets

Q121: Koutz Corporation uses activity-based costing to compute

Q122: Keske Corporation has an activity-based costing system

Q124: Kenrick Corporation uses activity-based costing to compute