Multiple Choice

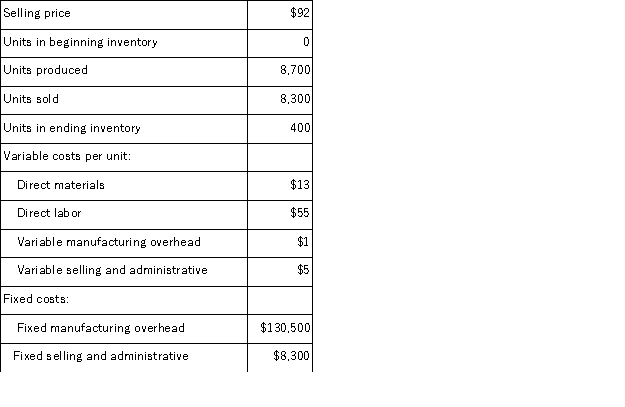

Farron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

A) $10, 600

B) $(17, 000)

C) $16, 600

D) $6, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q105: Harris Corporation produces a single product.Last year,

Q106: Aaker Corporation, which has only one product,

Q107: Chown Corporation, which has only one product,

Q108: During its first year of operations, Carlos

Q111: A manufacturing company that produces a single

Q113: Hogans Corporation has two divisions: Delta and

Q114: Elliot Corporation, which has only one product,

Q150: Under absorption costing, fixed manufacturing overhead costs:<br>A)are

Q215: Under absorption costing, fixed manufacturing overhead cost

Q234: When using data from a segmented income