Multiple Choice

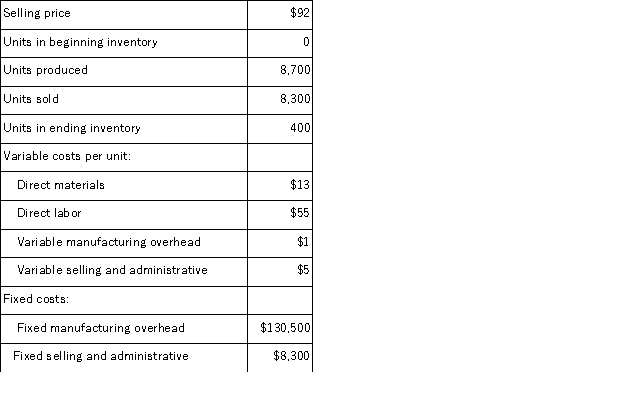

Farron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

A) $(17, 000)

B) $16, 600

C) $6, 000

D) $10, 600

Correct Answer:

Verified

Correct Answer:

Verified

Q114: Under variable costing, product cost does not

Q148: The principal difference between variable costing and

Q172: Last year, Rassel Corporation's variable costing net

Q179: Sosinski Corporation has two divisions: Domestic Division

Q181: Pevy Corporation has two divisions: Southern Division

Q185: O'Neill, Incorporated's segmented income statement for the

Q186: Clemmens Corporation has two major business segments:

Q187: Nelson Corporation, which has only one product,

Q188: A manufacturing company that produces a single

Q225: A common fixed cost is a fixed