Multiple Choice

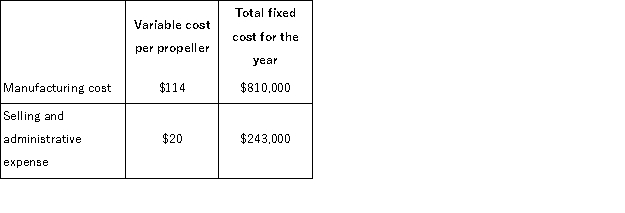

Cutterski Corporation manufactures a propeller.Shown below is Cutterski's cost structure:  In its first year of operations, Cutterski produced 60, 000 propellers but only sold 54, 000. Which costing method (variable or absorption) will generate a higher net operating income in Cutterski's first year of operations and by how much?

In its first year of operations, Cutterski produced 60, 000 propellers but only sold 54, 000. Which costing method (variable or absorption) will generate a higher net operating income in Cutterski's first year of operations and by how much?

A) variable by $81, 000

B) variable by $108, 000

C) absorption by $81, 000

D) absorption by $108, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q32: When sales are constant, but the number

Q68: The costs assigned to units in inventory

Q132: Propst Corporation has two divisions: Garden Division

Q133: Crystal Corporation produces a single product.The company's

Q134: Breedon Corporation produces a single product.Data concerning

Q137: Romasanta Corporation manufactures a single product.The following

Q139: Aaker Corporation, which has only one product,

Q140: Italia Espresso Machina Inc.produces a single product.Data

Q141: Hatfield Corporation, which has only one product,

Q155: Under absorption costing, the profit for a