Multiple Choice

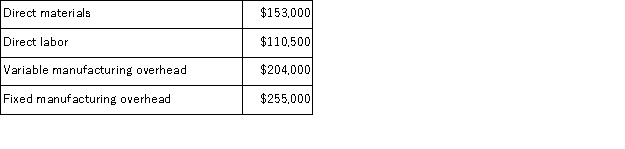

Harris Corporation produces a single product.Last year, Harris manufactured 17, 000 units and sold 13, 000 units.Production costs for the year were as follows:  Sales were $780, 000 for the year, variable selling and administrative expenses were $88, 400, and fixed selling and administrative expenses were $170, 000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing, the company's net operating income for the year would be:

Sales were $780, 000 for the year, variable selling and administrative expenses were $88, 400, and fixed selling and administrative expenses were $170, 000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing, the company's net operating income for the year would be:

A) $60, 000 higher than under absorption costing

B) $108, 000 higher than under absorption costing

C) $108, 000 lower than under absorption costing

D) $60, 000 lower than under absorption costing

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Under variable costing, fixed manufacturing overhead cost

Q57: Phong Corporation has two divisions: Consumer Division

Q58: Jarvix Corporation, which has only one product,

Q59: Peals Corporation has two divisions: Home Division

Q61: Delvin Corporation, which has only one product,

Q63: Yankee Corporation manufactures a single product.The company

Q65: Walkenhorst Corporation has two divisions: Bulb Division

Q66: Data for March for Lazarus Corporation and

Q217: When production exceeds sales and the company

Q233: The unit product cost under variable costing