Multiple Choice

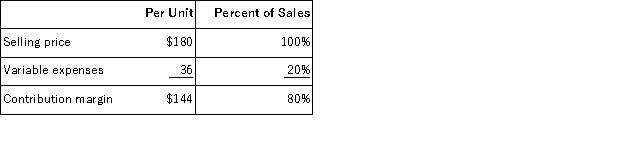

Salley Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $1, 133, 000 per month.The company is currently selling 9, 000 units per month.Management is considering using a new component that would increase the unit variable cost by $7.Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $1, 133, 000 per month.The company is currently selling 9, 000 units per month.Management is considering using a new component that would increase the unit variable cost by $7.Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $68, 500

B) decrease of $5, 500

C) increase of $68, 500

D) increase of $5, 500

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Morganti Corporation sells a product for $140

Q17: Malley Corporation has provided the following data

Q18: Lasseter Corporation has provided its contribution format

Q20: Blackner Corporation produces and sells a single

Q22: Garcia Veterinary Clinic expects the following operating

Q23: Eickhoff Corporation's contribution format income statement for

Q51: All other things the same, an increase

Q110: If two companies produce the same product

Q165: Cleckley Corporation's operating leverage is 5.9. If

Q175: Assume a company sells a single product.