Multiple Choice

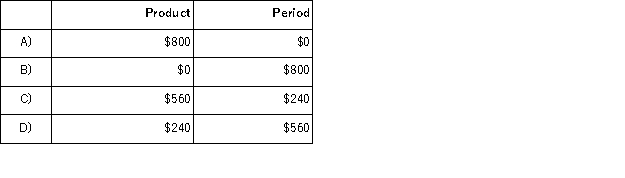

A manufacturing company prepays its insurance coverage for a three-year period.The premium for the three years is $2, 400 and is paid at the beginning of the first year.Seventy percent of the premium applies to manufacturing operations and thirty percent applies to selling and administrative activities.What amounts should be considered product and period costs respectively for the first year of coverage?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Property taxes on a manufacturing facility are

Q49: Searls Corporation, a merchandising company, reported the

Q53: Cosgrove, Inc. , is a wholesaler that

Q56: Callis Corporation is a wholesaler that sells

Q57: Which of the following is classified as

Q78: The engineering approach to the analysis of

Q123: Rent on a factory building used in

Q131: Erkkila Inc. reports that at an activity

Q140: Direct material costs are generally fixed costs.

Q173: In a traditional format income statement for