Essay

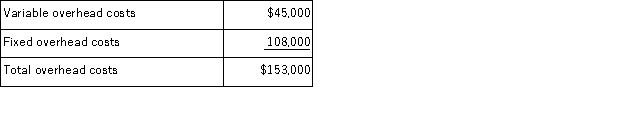

(Appendix 11A)Nova Corporation produces a single product and uses a standard cost system to help control costs.Overhead is applied to production on the basis of standard machine-hours.According to the company's flexible budget, the following overhead costs should be incurred at an activity level of 18, 000 machine-hours (the denominator activity level chosen for the current year):  During the current year, the following operating results were recorded:

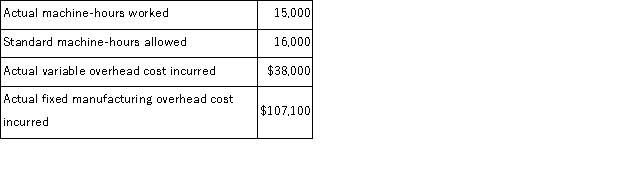

During the current year, the following operating results were recorded:  At the end of the year, the company's Manufacturing Overhead account showed total debits for actual overhead costs of $145, 100 and total credits of $136, 000 for overhead applied.The difference ($9, 100)represents under-applied overhead, the cause of which management would like to know.

At the end of the year, the company's Manufacturing Overhead account showed total debits for actual overhead costs of $145, 100 and total credits of $136, 000 for overhead applied.The difference ($9, 100)represents under-applied overhead, the cause of which management would like to know.

Required:

a.Compute the predetermined overhead rate that would have been used during the year, showing separately the variable and fixed components of the rate.

b.Show how the $136, 000 of overhead actually applied was computed.

c.Analyze the $9, 100 under-applied overhead figure in terms of the variable overhead rate and efficiency variances and the fixed manufacturing overhead budget and volume variances.

Correct Answer:

Verified

a.Predetermined overhead rate = Estimate...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: (Appendix 11A)Pohl Corporation uses a standard cost

Q101: (Appendix 11A)In a standard cost system, overhead

Q102: (Appendix 11A)The Dillon Corporation makes and sells

Q103: (Appendix 11A)Bakos Corporation bases its predetermined overhead

Q104: (Appendix 11A)Dexter Corporation uses a standard cost

Q106: (Appendix 11A)An unfavorable volume variance means that

Q107: (Appendix 11A)Reidenbach Corporation applies manufacturing overhead to

Q108: (Appendix 11A)Which of the following variances is

Q109: (Appendix 11A)Tillinghast Corporation estimates that its variable

Q110: (Appendix 11A)Acuff Corporation applies manufacturing overhead to