Multiple Choice

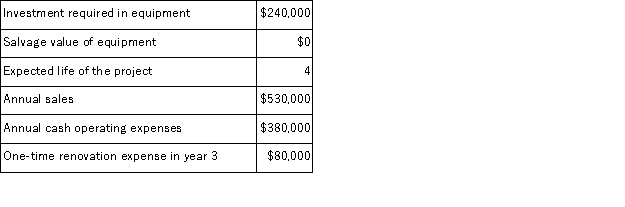

(Appendix 8C) Bosell Corporation has provided the following information concerning a capital budgeting project:  The income tax rate is 30%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment;the annual depreciation expense will be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The income tax rate is 30%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment;the annual depreciation expense will be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A) $142, 950

B) $320, 499

C) $80, 499

D) $196, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: (Appendix 8C)Gayheart Corporation is considering a capital

Q20: (Appendix 8C)Mitton Corporation is considering a capital

Q21: (Appendix 8C)Hauge Corporation is considering a capital

Q22: (Appendix 8C)Lanfranco Corporation is considering a capital

Q23: (Appendix 8C)Zucker Corporation has provided the following

Q25: (Appendix 8C)Boch Corporation has provided the following

Q26: (Appendix 8C)Gutshall Corporation is considering a capital

Q27: (Appendix 8C)El Corporation has provided the following

Q28: (Appendix 8C)Folino Corporation is considering a capital

Q29: (Appendix 8C)Lastufka Corporation is considering a capital