Multiple Choice

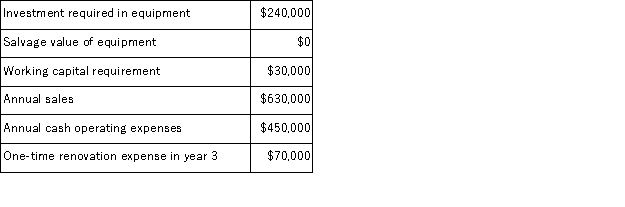

(Appendix 8C) The following information concerning a proposed capital budgeting project has been provided by Wick Corporation:  The expected life of the project is 4 years.The income tax rate is 35%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The expected life of the project is 4 years.The income tax rate is 35%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A) $101, 282

B) $224, 850

C) $119, 042

D) $266, 500

Correct Answer:

Verified

Correct Answer:

Verified

Q137: (Appendix 8C)Battaglia Corporation is considering a capital

Q138: (Appendix 8C)Stack Corporation is considering a capital

Q139: (Appendix 8C)Pilarz Corporation has provided the following

Q140: (Appendix 8C)Erling Corporation has provided the following

Q141: (Appendix 8C)Dekle Corporation has provided the following

Q142: (Appendix 8C)Folino Corporation is considering a capital

Q143: (Appendix 8C)Mota Corporation has provided the following

Q144: (Appendix 8C)Skolfield Corporation is considering a capital

Q145: (Appendix 8C)Voelkel Corporation has provided the following

Q147: (Appendix 8C)Faniel Corporation has provided the following