Multiple Choice

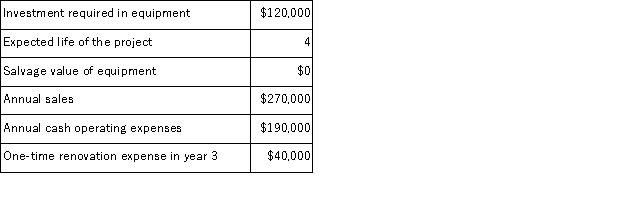

(Appendix 8C) Lasater Corporation has provided the following information concerning a capital budgeting project:  The company's tax rate is 35%.The company's after-tax discount rate is 15%.The project would require an investment of $10, 000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company's tax rate is 35%.The company's after-tax discount rate is 15%.The project would require an investment of $10, 000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A) $62, 500

B) $36, 500

C) $50, 000

D) $80, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: (Appendix 8C)Gouker Corporation has provided the following

Q14: (Appendix 8C)Brogden Corporation has provided the following

Q15: (Appendix 8C)Broxterman Corporation has provided the following

Q16: (Appendix 8C)Pont Corporation has provided the following

Q17: (Appendix 8C)Sader Corporation is considering a capital

Q19: (Appendix 8C)Gayheart Corporation is considering a capital

Q20: (Appendix 8C)Mitton Corporation is considering a capital

Q21: (Appendix 8C)Hauge Corporation is considering a capital

Q22: (Appendix 8C)Lanfranco Corporation is considering a capital

Q23: (Appendix 8C)Zucker Corporation has provided the following