Essay

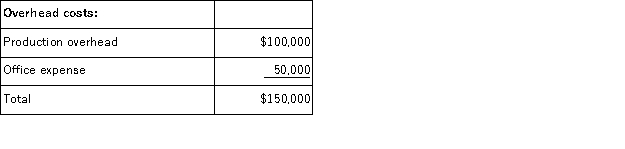

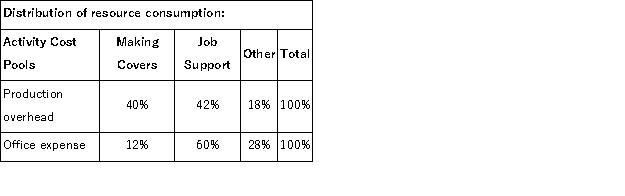

(Appendix 6A)Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

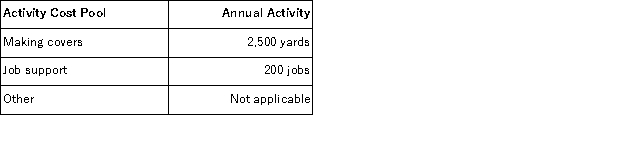

The amount of activity for the year is as follows:  Required:

Required:

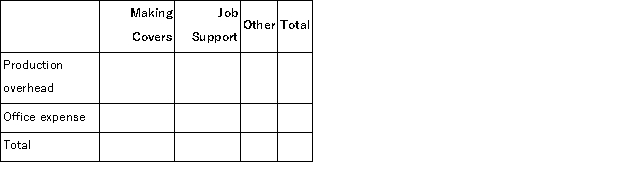

a.Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:

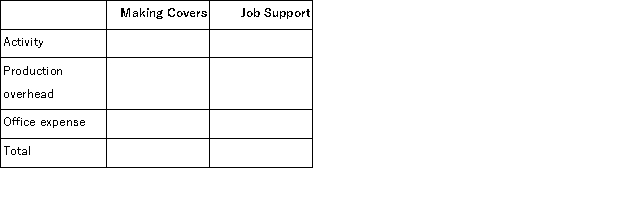

b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:  c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost;production overhead as a Red cost;and office expense as a Yellow cost.

Correct Answer:

Verified

a.First-stage allocation  b.Ac...

b.Ac...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: (Appendix 6A)If a cost object such as

Q4: (Appendix 6A)If a cost object such as

Q5: (Appendix 6A)Grogam Catering uses activity-based costing for

Q6: (Appendix 6A)Escau Corporation is a wholesale distributor

Q7: (Appendix 6A)Goel Company, a wholesale distributor, uses

Q9: (Appendix 6A)Ingersol Draperies makes custom draperies for

Q10: (Appendix 6A)Hasty Hardwood Floors installs oak and

Q11: (Appendix 6A)Escau Corporation is a wholesale distributor

Q12: (Appendix 6A)Jackson Painting paints the interiors and

Q13: (Appendix 6A)Grogam Catering uses activity-based costing for