Multiple Choice

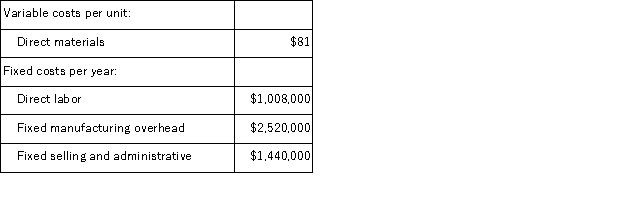

(Appendix 5A) Prehn Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 36, 000 units and sold 30, 000 units.The company's only product is sold for $251 per unit. The company is considering using either super-variable costing or an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 36, 000 units and sold 30, 000 units.The company's only product is sold for $251 per unit. The company is considering using either super-variable costing or an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.Which of the following statements is true regarding the net operating income in the first year?

A) Super-variable costing net operating income exceeds absorption costing net operating income by $6, 000.

B) Absorption costing net operating income exceeds super-variable costing net operating income by $588, 000.

C) Absorption costing net operating income exceeds super-variable costing net operating income by $6, 000.

D) Super-variable costing net operating income exceeds absorption costing net operating income by $588, 000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: (Appendix 5A)Quiller Corporation manufactures and sells one

Q19: (Appendix 5A)Moffa Corporation manufactures and sells one

Q20: (Appendix 5A)Under super-variable costing, which of the

Q21: (Appendix 5A)Sirmons Corporation manufactures and sells one

Q22: (Appendix 5A)The super-variable costing net operating income

Q24: (Appendix 5A)Wienecke Corporation manufactures and sells one

Q25: (Appendix 5A)Prehn Corporation manufactures and sells one

Q26: (Appendix 5A)Sagon Corporation manufactures and sells one

Q27: (Appendix 5A)Feltner Corporation manufactures and sells one

Q28: (Appendix 5A)Feltner Corporation manufactures and sells one