Essay

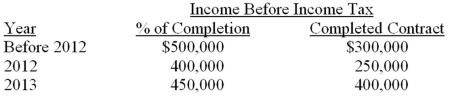

On January 1, 2013, Bubba Construction decided to change from the completed contract method of accounting for long-term construction contracts to the percentage-of-completion method. The company will continue to use the completed contract method for tax purposes. The tax rate is 30%. The following is all relevant data concerning the change.  Required:

Required:

Prepare the journal entry to record the accounting change.

Correct Answer:

Verified

($500,000 + $400,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Diversified Systems, Inc., reports consolidated financial statements

Q8: How are accounting errors treated?

Q16: Which of the following is a change

Q22: Most changes in accounting principle require a

Q23: Albatross Company purchased a piece of machinery

Q26: Name and briefly describe the three categories

Q61: Which of the following changes would not

Q81: Which of the following is not an

Q92: Indicate the nature of each of the

Q105: A change that uses the prospective approach