Multiple Choice

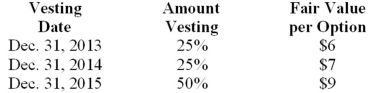

Yellow Company is a calendar-year firm with operations in several countries. At January 1, 2013, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $30. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards, what is the compensation expense related to the options to be recorded in 2014?

Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards, what is the compensation expense related to the options to be recorded in 2014?

A) $40,000.

B) $60,000.

C) $95,000.

D) $130,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: On January 1, 2013, Shamu Corporation had

Q18: Which of the following is a correct

Q19: Under its executive stock option plan, Q

Q21: Fully vested incentive stock options for 60,000

Q24: When the income statement includes separately reported

Q25: Sugarland Industries reported a net income of

Q28: What is restricted stock? Describe how compensation

Q78: What is the treasury stock method of

Q148: In computing diluted earnings per share, the

Q222: If previous experience indicates that a material