Essay

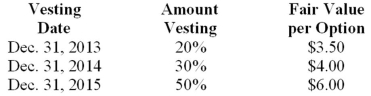

Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2013, the company had issued 20 million executive stock options permitting executives to buy 20 million shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows:  Required:

Required:

Determine the compensation expense related to the options to be recorded each year for 2013-2015, assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards.

Correct Answer:

Verified

The compensation cost is allo...

The compensation cost is allo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: When computing diluted earnings per share, which

Q108: On December 31, 2012, Belair Corporation had

Q110: On January 1, 2013, G Corp. granted

Q115: On March 1, 2017, when the market

Q116: During the current year, East Corporation had

Q155: The tax code differentiates between qualified and

Q159: How many types of potential common shares

Q167: The calculation of diluted earnings per share

Q170: What is Rudyard's diluted EPS (rounded)?<br>A)$2.13.<br>B)$2.67.<br>C)$3.20.<br>D)$4.80.

Q172: Reacting to opposition to the FASB's "Share-Based